How to increase net worth in your late 50’s to pay debts for good and retire comfortably.

Your net worth is your own personal metric to see how well you manage your own financial success.

Do you know your current net worth?

Most people don’t take the time to calculate it and I must admit that I’m one of them when I was living in New York, I borrow my lifestyle from credit card debts.

We all do not want debts and there’s no way to sugar coat it because living paycheck to paycheck is not the kind of thing that brings happiness or peace at home.

If your net worth is in the red, you’ll need to work on spending less and find ways how to improve it. Start with the rates you are paying on borrowed money and begin chipping away at the highest-interest debt first, especially credit cards.

Even if you don’t drive a Lamborghini or stay in a 6-star hotel, knowing your net worth is an important piece to improve your financial health.

Proverbs 22:7

The rich rule over the poor and the borrower is a slave to the lender.

Easy Ways To Increase Net Worth To Design Your Future & Live Comfortably Before Retirement

1. Cut Expenses

Most people live paycheck to paycheck and don’t have enough money to save. People think it’s hard to save because their income is too low to pay for basic necessities.

But in many situations, people don’t save enough not because they make too little but because they spend too much.

I know this because I used to be one of them several years ago.

We all know how small expenses can add up quickly like eating out, Starbucks coffee, or buying the latest gadgets.

The intention is not to stop drinking coffee or eating out, but instead to monitor the ins and outs of your money and make some adjustments to create the version of the life you deserve.

Resources: Video + Worksheet

2. Make a Monthly Budget

I know living on a budget is not fun.

I made a lot of sacrifices from eating outside, shopping, go out with cash only, and prioritizing paying all my debts in two years’ time.

In short, practice delay gratification that will pay off for you for the long term.

Using a budget to set limits is a good place to start.

3. Don't Keep Changing Your Car

Buy the car you will drive longer until it needs to be replaced because the car depreciates and this will decrease your net worth if you keep changing car frequently.

Aside from depreciation, the cost of insurance and maintenance costs will also add up to monthly expenses.

4. Save For Emergency Fund

Life often gives us unexpected money problems. That’s why it’s so important to have money set aside for emergencies.

There are several unexpected expenses, whether you just got fired, or a sudden illness. The emergency fund comes into play when life throws you a major curveball, you have money to fall back on.

There was a time in my life when I believed if you worked hard and did your job well – your job was safe forever.

So by the time, I left my full-time job and began my business startup from home in 2012, I have savings to fall back on.

5. Keep Money You Have Saved Where It Will Grow

If you have savings in the bank, you are not working towards increasing your net worth. Invest it in something that will continue to reap the benefits well into the future.

If you know something well enough to teach, write about, or speak about to help someone who will compensate you for that knowledge turn your expertise to income to increase your net worth.

This is one of the steps I made after I quit my job by turning my experience and what I know into a resource.

6. Pay Off All Debt For Good

Pay off all your credit card debt as soon as you are able.

Many people plan to pay off debts but fail because there’s no BIG motivation behind them. You have to continually remind yourself of the reasons why you want to get out of debt.

Like for example in my case, I want to secure my future for me NOT to depend on anyone or anything when it comes to money and I’d like to spend quality time with my family traveling around the world and do things that matter to me.

How to increase net worth is a BIG goal. The want and the why has to be strong. Once you become debt-free, you’ll be able to work toward becoming financially secure.

7. Invest With Certainty

Once you already have the money to invest, invest it with certainty by buying companies that have meaning to you.

I’m sure that you do not want to lose your hard-earned money on something that you don’t understand.

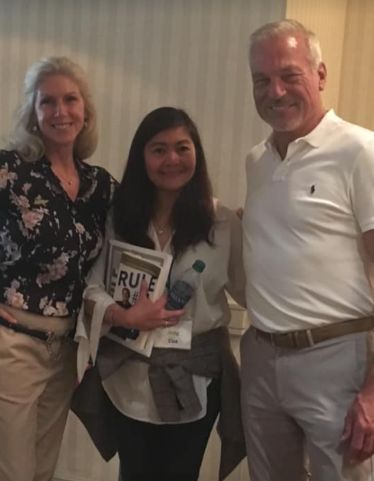

When I was still working as an ex-pat executive in Thailand, I’ve read this book about investing and during those years, I don’t have the money to invest and who would have thought that I will go to Atlanta, Georgia in 2019 and able meet the author of this book and hang out at his ranch.

Increasing your net worth requires patience!

Conclusion

Don’t waste the opportunity to improve your net worth.

I definitely enjoy making extra money so I can give away more money to those who need it.

In my 2-year quest to become debt-free, I found myself learning about many things on which I can improve myself and net worth. From investing in derivatives, turning my expertise to income, and have tried many ways to continually gain new streams of revenue.

I can assure you that if you hold accountable and monitor the ins and outs of your money and do the 7 simple things I listed above, I hope that these tips help you along your breakthrough journey on how to increase your net worth to design your future!

I hope that this post has helped you!

Go grow and take full responsibility for your own outcomes to design your future. You won’t know what you don’t know until you actually do it.

Don’t always sit on the sidelines in the game of life when you could be out there living it! Life is short! Enjoy it to the fullest!

Also, a simple request. If you liked this post, please share it!

– Pin it! – Tweet it! – Share it to your favorite Facebook group + favorite blog

Thank you so much, my friend.